SOA in Core Banking

Abstract: Nowadays there are huge discussions on different software architecture approaches, and the most well-known one is Service Oriented Architecture (SOA). Existence of legacy applications as unwieldy weapons impact the technologies in a way that integration frameworks had been in the battle of consumers. A seismic architecture and technology in some businesses elevated sense of urgency; one of these businesses is core banking. Core banking is dissipating hence using service orientation in related applications is not a choice.

Why SOA?

Gartner has evaluated the competitive landscape of core banking vendors that service the future of the international retail banking market. Gartner’s evaluation has uncovered the leading strategies of these vendors/products, revealed their underlying product/service capabilities and affirmed their relevance to the changing conditions of the banking industry [REF-1]. Gartner has been concentrated on following items:

- Research side: The evaluation began with 32 candidates for the International Retail Core Banking (IRCB) Magic Quadrant for 2008 and resulted in a qualified group of 22 combinations of vendors and products that represent the major movers in the retail core banking system market. This final group submitted information ranging from long-term strategies through to product road maps. Additionally, Gartner conducted interviews with reference banks to resolve the placement of group finalists on the Magic Quadrant [REF-1].

- Core Banking System definition is a back-end system that processes daily banking transactions and posts updates to accounts and other financial records. Core banking systems typically include deposit, loan and credit-processing capabilities, with interfaces to general ledger systems and reporting tools. Gartner's IRCB Magic Quadrant assesses vendors on the multicurrency products they offer in support of a bank's financial transaction management in the retail banking market [REF-1].

- The main challenge: Gaining access to customer information — a challenge with product-centric core solutions — is definitely a driver for adopting open, easily integrated core banking systems [REF-1].

- Core Banking Road Map: The maturation of middleware messaging architectures and the evolutionary path to services and event-driven constructs are leading to opportunities that will unlock the single-use logic in these line-of-business (LOB) solutions. Development techniques, such as service-oriented development, are focusing on creating components of fine and coarse granularity that may be exposed to services. For example, a common interest accrual component is used across all front- and back-office applications to provide consistency and accuracy while extending reusability [REF-1].

And finally, and the reason of such road map is [REF-1]:

“These types of technology innovations are simplifying the maintenance and support of products while reducing the volatility commonly associated with the introduction of new products and services. Some core banking vendors already are progressing quickly to achieve componentization of their back-office offerings. Because changes in banking functionality haven't been market movers, many packaged core banking vendors have been afforded the opportunity to play catch-up with product functionalities that once served as differentiators in homegrown or highly customized solutions — especially in large bank markets. ”

Besides, by evaluating some of these vendor’s architectures, effortlessly you can find that the most of architectures are going to be close to service oriented architecture (SOA), as a proof of this idea following issues have been taken place.

- Alnova Financial Solutions™ is Accenture's state-of-the-art custom banking solution. This cora banking platform covers all aspects of universal banking; it handles traditional business products as well as products designed for wholesale banking and wealth management, all in an integrated, browser-based environment that crosses multiple delivery channels. Leveraging market-proven technology, this scalable solution allows banks to achieve high performance today, and in the future. A three-tier technological banking platform, Alnova Financial Solutions is flexible, allowing clients to tailor it to their individual environments. Running on Mainframe, Unix and Microsoft .NET platforms using the most widely known databases (DB2, Oracle, SQL Server, etc.), the architecture is designed to align with service-oriented architecture (SOA) [REF-2] principles, including business processes and interoperability, service location transparency, and standards-based implementation via Web services.

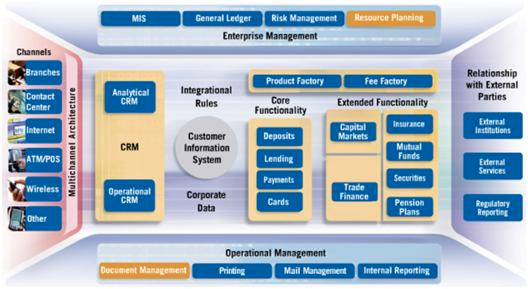

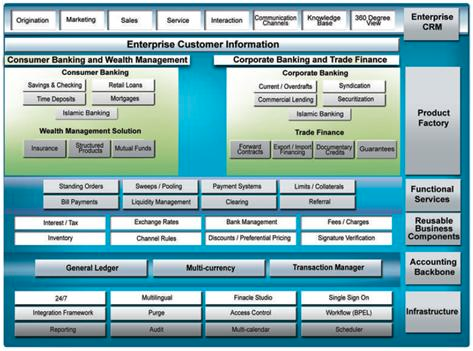

- Infosys Technologies (Finacle): The solution has an integrated CRM module enabling banks to offer a rich and differentiated value proposition to customers. The layered Service Oriented Architecture (SOA), STP capabilities, web-enabled technology and 24 X 7 operations ensure multi-channel, multi-country and multi-currency implementations. The functionality-rich modules in the solution provide banks with a varied palette of features to continuously innovate on their product and service offerings. With Finacle core banking solution, banks can meet the challenges of managing change, competition, compliance and customer demands effectively. [REF-3]

FNIS (Core24): The component for reporting to customers makes it possible KORDOBA CORE24 enables banks to adjust their software to their own strategies, helping them set themselves apart from the competition. An extensive range of user program interfaces and the online parameterization mean it can be extended to suit the needs of individual customers without modifying the standard solution. By using the pervasive SOA services the connection to an existing middleware and orchestration of business processes is easily possible. [REF-4]

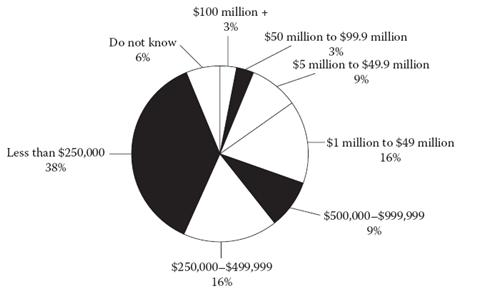

And overall in the following diagram you can find the segmentation of SOA investments [REF-5]:

Enabling SOA in core banking

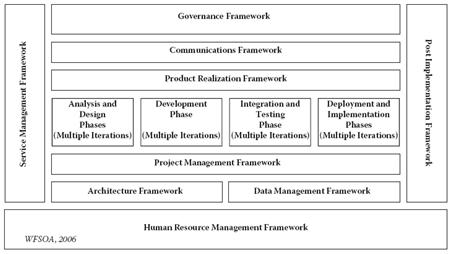

If we want to enable service oriented architecture in a core banking atmosphere, we need to have methodology. The best and only the one methodology that can be found on SOA is called Methodology for Enabling Service Oriented Architecture (MESOA), which is pictured on following image [REF-6]:

The Process

Starting by SOA in banking should have be in a specific manner, the way that makes SOA more compatible into your bank is as same as following structure:

- Business Vision Axis

- Developing vision and mission

- Developing strategies

- Evaluating line of business and functional areas

- Delineating key business requirement for each area of the business

- Current State Axis

- Define business capabilities

- Define technical capabilities

By having both axes right now you can have a gap among Current State Axis and Business Vision Axis, then the final map is:

- Grouping gaps by plans

- Design the roadmap and prioritize the plans

- Develop detail requirements

- Develop final RFP

In your strategic planning activities you should have following teams: project management, business team, and technology team.

Reference Architecture based on SOA

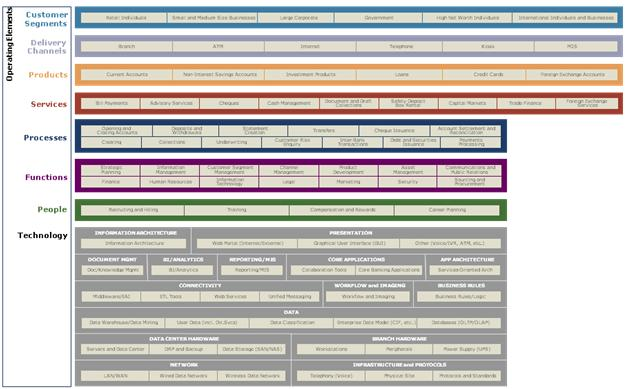

The Reference Architecture is a framework used as a single point of reference to illustrate the key operating elements of the core banking solution. The reference architecture has following categories: technology, people, functions, processes, services, products, delivery channels, and customer segments.

Technology

As a technology part the following items are mandatory:

- Information architecture

- Enterprise Service Bus

- Business Process Executive Language (BPEL)

- Presentation

- Enterprise web portal such as Liferay [REF-7]

- Graphical User Interface (GUI)

- Other (voice, ATM, etc…)

- Web Content Management (WCM) or document management, such as Alfresco [REF-8]

- Business Intelligence (BI) and reporting tool such as Pentaho

- Core applications

- Collaboration tools

- Core banking applications

- Connectivity

- Middleware or Enterprise Application Integration (EAI)

- Extract, Transform, and Load (ETL) tools

- Web services

- Unified messaging

- Business Process Machine (BPM) or WS-HumanTasking

- Business Rule Engine Management System (BRMS)

- Data

- Data warehouse

- OLTP

- OLAP

- Data warehouse

- Data mining

- User data

- Data classification

- Enterprise data model

- Data Center

- Servers

- Disaster Recovery Plan and backups

- Data storage (SAN and NAS)

People

As a people part the following items are mandatory:

- Recruiting and hiring

- Training

- Compensation and rewards

- Career planning

Functions

As a function part the following items are mandatory:

- Strategic planning

- Information management

- Customer segment management

- Channel management

- Product development

- Asset management

- Communications and public relations

- Finance

- Human resources

- Information technology

- Legal

- Marketing

- Security

- Sourcing and procurement

Processes

As a process part the following items are mandatory:

- Opening and closing accounts

- Deposits and withdrawals

- Statement creation

- Transfers

- Cheque issuance

- Account settlement and reconciliation

- Clearing

- Collections

- Underwriting

- Customer risk enquiry

- Internal bank transactions

- Debt and securities issuance

- Payments processing

- Anti Money Laundering (AML)

Services

As a service part the following items are mandatory:

- Bill payments

- Advisory services

- Cheques

- Cash management

- Document and draft collections

- Safety deposit box rental

- Capital markets

- Trade finance

- Foreign exchange services

Products

As a product part the following items are mandatory:

- Current accounts

- Non-interest savings accounts

- Investment products

- Loans

- Credit cards

- Foreign exchange accounts

Delivery Channels

As a delivery channel part the following items are mandatory:

- Branch

- Automatic Teller Machine (ATM)

- Internet

- Telephone

- Kiosk

- Point of sale (POS)

Customer Segments

As a customer segment part the following items are mandatory:

- Retail individuals

- Small and medium size businesses

- Large corporate

- Government

- High net worth individuals

- International individuals and businesses

All above items can be figured in following image:

References:

REF-1: Magic Quadrant for International Retail Core Banking, 3 April 2008 by Don Free. Gartner Industry Research Note G00156674.

REF-3: Infosys Technologies (Finacle), Core Banking Solution

REF-4: The Complete Banking Solution for the 21st Century – KORDOBA CORE24

REF-5: Information Week Research SOA/Web Services Survey of 273 business technology professionals in 200 firms using SOA/Web Services [Multiple Responses], September 2006.

REF-6: Service-Oriented Architecture SOA Strategy, Methodology, and Technology (2008) by Thomas Erl. (page:30)

REF-7: www.liferay.com

REF-8: www.alfresco.com